BTC Price Prediction: Path to $200,000 Amid Evolving Market Dynamics

#BTC

- Technical Consolidation: Current price action near Bollinger lower band suggests accumulation opportunity with MACD showing potential reversal signals

- Institutional Catalyst: BlackRock's ETF filing and growing regulatory acceptance provide fundamental support for long-term price appreciation

- Market Cycle Extension: Analysts project extended Bitcoin cycle to 2026, allowing more time for the $200,000 target to materialize with proper catalyst alignment

BTC Price Prediction

BTC Technical Analysis: Consolidation Phase Signals Potential Breakout

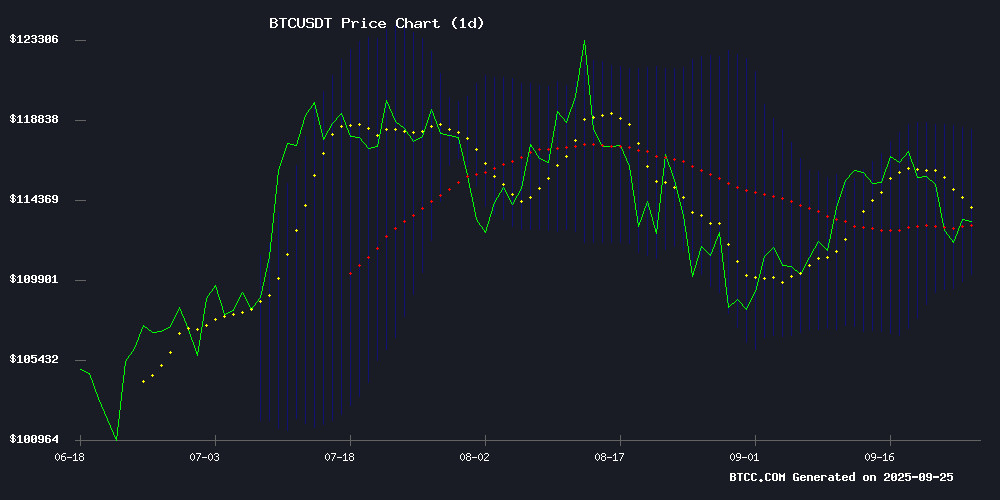

BTC is currently trading at $109,349.84, below its 20-day moving average of $114,055.60, indicating short-term bearish pressure. The MACD reading of -1,455.91 shows weakening momentum, though the narrowing gap between MACD and signal line suggests potential trend reversal. Bollinger Band positioning NEAR the lower band at $109,494.35 indicates BTC is testing support levels, which could present accumulation opportunities for long-term investors.

According to BTCC financial analyst Emma, "The current technical setup shows BTC consolidating within a tight range. The proximity to Bollinger's lower band combined with MACD convergence suggests we're approaching a potential inflection point. A sustained hold above $109,000 could trigger upward momentum toward the middle band resistance at $114,055."

Market Sentiment: Institutional Developments Offset Short-Term Volatility

Recent developments highlight contrasting market forces. BlackRock's massive Bitcoin ETF filing signals growing institutional acceptance, while cooling CEX flows indicate accumulation behavior among long-term holders. Regulatory advancements in Ohio and growing adoption in conflict zones like Ukraine demonstrate Bitcoin's expanding utility.

BTCC financial analyst Emma notes, "The BlackRock ETF news represents a watershed moment for institutional adoption, potentially offsetting current macroeconomic pressures. However, the strong dollar and extended cycle predictions suggest investors should prepare for continued volatility before the next major upward move."

Factors Influencing BTC's Price

BlackRock’s $12.5T Bitcoin ETF Filing Shakes Markets — Is Approval Imminent?

BlackRock, the world’s largest asset manager, has filed an application for a Bitcoin Premium Income ETF, signaling a potential watershed moment for institutional crypto adoption. The $12.5 trillion firm seeks to expand its dominance in cryptocurrency products with a covered-call strategy designed to generate yield on Bitcoin holdings.

The proposed iShares Bitcoin Premium ETF follows the success of BlackRock’s $87 billion iShares Bitcoin Trust (IBIT). Bloomberg analyst Eric Balchunas notes the filing positions the product as a '33 Act spot offering, tailored for traditional finance investors seeking crypto exposure with income generation.

This move accelerates BlackRock’s digital asset expansion at a time when institutional demand for bitcoin products reaches unprecedented levels. Approval could further legitimize cryptocurrency as an asset class while reinforcing BlackRock’s leadership in crypto ETF innovation.

Bitcoin Market Shifts Into HODL Mode As CEX Flows Cool Down

Bitcoin faces renewed selling pressure but holds firm above the critical $110,000 support level, signaling a pivotal battleground for market sentiment. Bulls remain cautiously optimistic as the asset demonstrates resilience amid broader volatility, fueling speculation of an impending surge once current selling pressure subsides.

Fear lingers among traders weighing potential corrections, yet underlying demand appears robust enough to sustain long-term price appreciation. Analyst Axel Adler notes a decisive shift in market behavior: centralized exchange flows have cooled significantly, with gross activity plummeting from earlier peaks. The FLOW Activity Pressure metric now sits at 9—firmly in the lower zone—suggesting the market has entered what Adler describes as 'HODL mode.'

This cooling of speculative activity on exchanges may reduce downside risks while creating conditions favorable for accumulation. The data paints a picture of investors moving away from short-term trading and toward long-term positioning—a dynamic that historically precedes upward price momentum.

IBM's Quantum Roadmap Sparks Debate Over Bitcoin's Cryptographic Future

IBM's ambitious Starling project aims to deliver a fault-tolerant quantum computer by 2029, capable of performing 20,000x more operations than current systems. The development raises existential questions for Bitcoin, whose SHA-256 encryption could theoretically be broken by such technology.

The breakthrough hinges on qLDPC error-correction codes, which efficiently scale logical qubits. While IBM's phased rollout begins with test systems in 2025-2027, the crypto community remains divided on the timeline for quantum threats to materialize.

Market observers note Bitcoin's price stability despite the news, suggesting investors view quantum risk as a long-term consideration rather than immediate threat. Altcoins with quantum-resistant algorithms may see renewed interest as the 2029 deadline approaches.

Macroeconomic Shifts Extend Bitcoin's Cycle to 2026, Analysts Say

Bitcoin's historical four-year cycle is showing signs of elongation, with analysts now projecting the next major price peak to occur in 2026 rather than the previously anticipated 2024-2025 window. The shift is attributed to macroeconomic factors, particularly the maturation of U.S. corporate debt and sustained high interest rates.

Raoul Pal of Altcoin Daily notes that corporate debt maturities—typically spanning 4 to 5.4 years—are slowing the broader business cycle. This delay cascades into crypto markets, disrupting Bitcoin's post-halving bull run pattern. The asset previously peaked at $1,000 (2012), $20,000 (2016), and $69,000 (2020) following halving events.

Interest rate pressures compound the effect. Main Street faces tightening credit conditions while institutional players capitalize on yield opportunities. The result is a divergence between traditional economic timelines and crypto market dynamics.

Bitcoin’s Cup & Handle Formation Suggests Imminent Price Expansion

Bitcoin's price action is mirroring historical breakout patterns, with analysts identifying a recurring cup-and-handle formation that previously preceded steep rallies. Chartists point to $111K as critical support, while resistance looms NEAR $123K.

Crypto analyst Merlijn The Trader emphasizes Bitcoin's cyclical nature, noting similar technical setups in 2015-2017 (rounding bottom), 2018-2020 (Adam & Eve), and 2021-2024 (cup-and-handle). Each pattern culminated in explosive price movements after the Relative Strength Index crossed 70—a threshold Merlijn describes as the "ignition switch" for parabolic advances.

Michaël van de Poppe highlights $111,600 as a key support zone, with the $111,500-$112,000 range undergoing repeated tests. The market appears poised for expansion if these levels hold, continuing Bitcoin's historical pattern of consolidation followed by rapid appreciation.

UK and Dutch Bitcoin Reserve Claims Gain Traction Amid Regulatory Uncertainty

Political momentum for Bitcoin reserves is building in the UK and Netherlands, though regulatory hurdles remain substantial. Nigel Farage, the frontrunner in UK election polls, has amplified market speculation by urging the Bank of England to embrace digital assets—stopping short of explicitly endorsing BTC reserves but signaling alignment with crypto adoption.

The viral Twitter exchange highlights growing institutional interest, yet concrete policy action lags behind rhetoric. Market observers note the influence of former US President Trump's unrealized Bitcoin Strategic Reserve proposal on global central bank discourse.

While Farage's conference appearances and public statements demonstrate political will, the absence of formal BTC reserve proposals or regulatory frameworks tempers expectations. The Bank of England's current stance remains cautious despite political pressure.

Bitcoin Implied Volatility Hits The Floor — Is The Market Poised For Next Big Shift?

Bitcoin's price shows tentative signs of recovery after a mid-week rebound, yet the cryptocurrency remains entrenched in bearish territory, currently trading near $111,000. Analysts detect brewing momentum beneath the surface as critical on-chain metrics signal diminishing volatility—a potential precursor to renewed upward movement.

XWIN Research, a prominent Japanese analytics firm, identifies striking parallels between current market conditions and the prelude to Bitcoin's historic 2023 rally. The firm highlights Bitcoin's implied volatility ratio plunging to multi-year lows, mirroring levels last seen before the asset's 325% surge from $29,000 to $124,000. This compression typically precedes major price movements as markets consolidate before decisive breaks.

Market structure appears to be transitioning from speculative frenzy to institutional-grade stability. The volatility contraction suggests growing conviction among long-term holders, with traders increasingly looking beyond short-term noise. Such conditions historically favor sustained bullish trajectories rather than ephemeral pumps.

How Neopool Is Reshaping Bitcoin Mining Through Tech Innovation

Mining pools face mounting pressure to balance profitability with environmental concerns as the sector evolves. Neopool, a rising player now ranked among the top 15 global pools by hashrate, is betting on algorithmic efficiency to address these challenges.

"Today's mining isn't just about hardware power," says CEO Andrey Kopeykin. The platform's 15 EH/s capacity and 0.001 BTC minimum withdrawals cater to both industrial and retail miners. Daily automated payouts and proprietary task optimization algorithms FORM the backbone of its value proposition.

While Bitcoin remains Neopool's clear focus, the pool's tech-driven approach could influence broader mining practices as energy efficiency becomes non-negotiable. The Dubai blockchain event spotlighted how operational transparency is now as crucial as raw computational might.

Ukraine Emerges as Heavy Crypto User Amid War, with $1 Billion in Annual Transactions

Ukraine has become a significant player in the cryptocurrency market, with citizens purchasing over $1 billion in digital assets in a single year. The European Bank for Reconstruction and Development (EBRD) highlights the country's surge in crypto activity, attributing it to institutional and professional transfers amid wartime financial restrictions.

Cryptocurrency adoption in Ukraine accelerated following Russia's invasion, as citizens turned to digital assets to bypass fiat currency limitations imposed under martial law. The EBRD's Regional Economic Prospects report reveals Ukraine received $106 billion in crypto inflows and spent $882 million in hryvnia on Bitcoin purchases between July 2023 and July 2024.

Large-scale transactions—ranging from $10,000 to $10 million—dominate Ukraine's crypto landscape, signaling institutional participation. Nigeria also stands out as a leading adopter, though Ukraine's wartime context makes its crypto boom particularly noteworthy.

Strong Jobs Report Sends Dollar Flying As Bitcoin Falls Below $111K

The U.S. dollar surged to a three-week high following a stronger-than-expected jobs report, while Bitcoin tumbled below $111,000 as risk assets faced pressure. Initial jobless claims dropped to 218,000—a two-month low—and Q2 GDP growth was revised upward to 3.8%, dampening expectations of aggressive Federal Reserve rate cuts.

Market odds for an October rate cut fell to 85.5% from 92%, per CME Group data, as Fed Chair Powell emphasized caution despite calls for faster easing. Bitcoin's decline coincided with slowing ETF inflows and accelerated distribution by long-term holders, signaling exhaustion in both spot and futures markets.

The Dollar Index (DXY) ROSE 0.3%, compounding headwinds for cryptocurrencies. Glassnode analysts noted a fragile balance in Bitcoin's supply-demand dynamics, with institutional absorption waning post-FOMC.

US Ohio Approves Bitcoin Payments for Taxes and State Services

Ohio has become the latest US state to embrace cryptocurrency, authorizing Bitcoin as a valid payment method for taxes, business filings, licenses, and other government services. The MOVE signals growing institutional acceptance of digital assets as a medium of exchange.

This development positions Ohio at the forefront of crypto adoption among state governments, potentially setting a precedent for broader regulatory acceptance. Market observers note such initiatives often precede increased retail and institutional participation in crypto markets.

Will BTC Price Hit 200000?

Based on current technical indicators and market developments, reaching $200,000 requires several key catalysts to align. The current price of $109,349.84 would need approximately 83% appreciation to achieve this target.

| Metric | Current Value | Required Movement |

|---|---|---|

| Current Price | $109,349.84 | Base |

| Target Price | $200,000.00 | +83% |

| 20-day MA Resistance | $114,055.60 | First hurdle |

| Bollinger Upper Band | $118,616.85 | Near-term ceiling |

BTCC financial analyst Emma explains: "While $200,000 represents an ambitious target, the combination of potential ETF approvals, institutional adoption trends, and the cup and handle formation noted in technical analysis creates a plausible path. However, investors should monitor key resistance levels and macroeconomic factors that could impact the timeline."